Contents

Government Efforts

Government Efforts to support Digital Banking and Digital Accounting in India In the past few years, the government of India has made a lot of positive strides towards encouraging digital banking and accounting, as well as the goal of ultimately building a cashless and transparent economy. The initiatives of digital banking not only support inclusion, but also provide businesses and individuals with money management tools to manage or be mindful about their money in an efficient and secure manner.

Primary Government Program

Primary Government Endeavours Digital India is usually the flagship government programme, and it set the stage for an all-encompassing digital infrastructure for the nation. Digital India is to empower citizens, by making digital services, such as e-banking and online accounting, accessible to them.

The Pradhan Mantri Jan Dhan Yojana – PMJDY Scheme

Millions of people opened bank accounts, many opened for the first time! The new bank accounts are all linked with Aadhaar and mobile numbers, so together they have enabled direct benefit transfers (DBT). The use of Aadhaar for account verification, and banking transfers cut down on errors, the possibility of corruption, and the wait time for recipients on government transfers.

Power of UPI

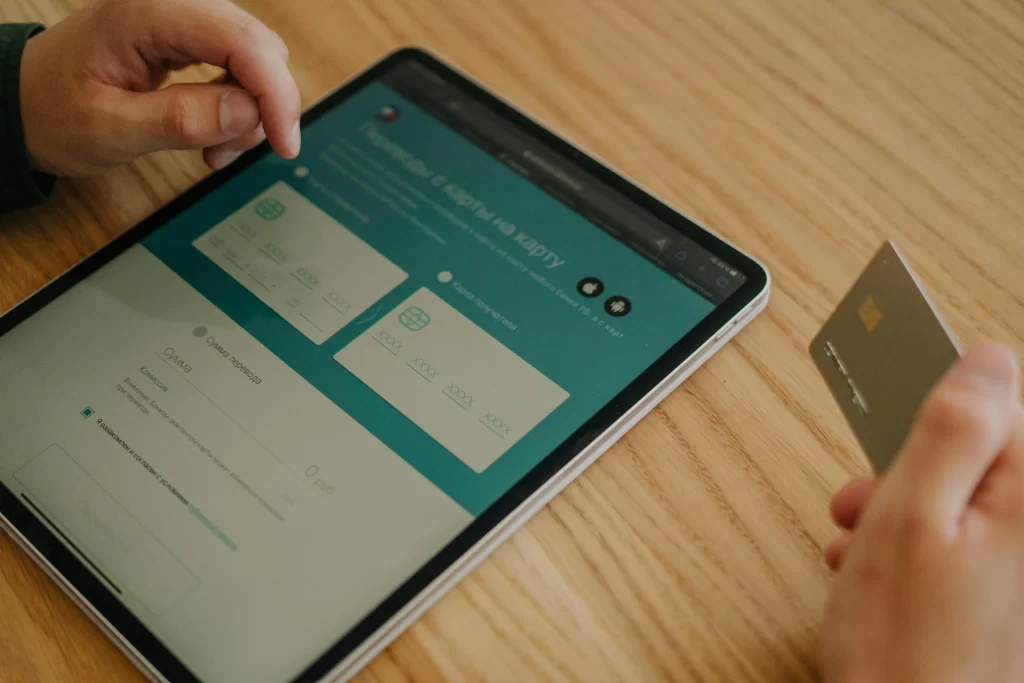

In India when UPI, which stands for (Unified Payments Interface) was introduced, the digital payment system was upgraded, and made it easier for those parties involved in cashless payment. UPI is a service where people can transfer money and pay to any one through smartphones. UPI is a secure method of purchase, and as a result encouraged numerous cashless transactions. Many interface mappings of apps for UPI payments exist, the most commonly identified are paytm, phonepe, and google pay; all commonly used within their own limits and recognized as easily accessible.

Aadhar Enabled Payment System

The government also started Aadhaar Enabled Payment System (AePS), which is like a no-frills bank account, and introduced e-RUPI, a virtual currency that can enable the automated payment of goods/services for designated uses.